Property Assessment Notices Start Arriving This Week

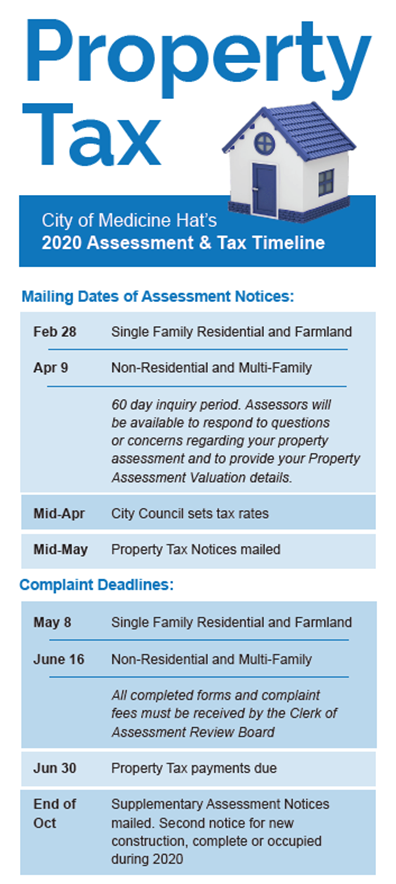

Property Assessment Notices will begin arriving in resident’s mailboxes beginning February 28, 2020 for Single Family Residential and Farmland properties. Property owners of Non-Residential and Multi-Family properties will receive their notices a month later beginning April 9, 2020.

Assessment Notices are now being mailed out earlier and under separate cover from the Property Tax Notices. This allows the department more time to respond to and deal with individual assessment queries and concerns before property tax payments are due.

Legislation allows property owners 60 days from the Notice of Assessment date (March 9, 2020) to review and discuss any concerns with the City’s Assessment Department. It is important to contact the Assessment Department for an explanation before filing an appeal. Purchasers of property should obtain or confirm the assessment value if the sale occurs during the appeal period.

City Council sets the annual tax rate in April, and tax notices are mailed out in May. Property assessment appeals for Single Family Residential and Farmland property must be received by the Clerk of the Assessment Review Board May 8, 2020. The final date of complaint for Non-Residential and Multi-Family properties will be June 16, 2020.

Tax payments are due June 30, 2020. It is important to note that property owners and purchasers must review their Assessment Notices before the 60 day appeal period ends as Property Tax Notices cannot be disputed once the appeal period ends.

For further information, please contact

Sue Sterkenburg

City Assessor

City of Medicine Hat

assessment@medicinehat.ca

https://www.medicinehat.ca/

You can also read our municipal and provincial policy on assessment here.