Your Weekly Tune Up

Alberta Mid-Year Financial Update

Alberta continues to lead the nation in economic growth and is forecasting a surplus of $5.5 billion in 2023-24, an increase of $3.2 billion from Budget 2023. The province's fiscal outlook continued to improve in the second quarter of 2023-24, boosted by strong bitumen royalties and higher income tax revenues.

However, volatile oil prices, continued inflation challenges and uncertainty due to slowing global growth could still affect the province's finances going forward. Debt servicing costs will be higher than previous years due to higher interest rates, reinforcing the importance of the government's commitment to balance the budget.

Revenue for 2023-24 is forecast at $74.3 billion, a $3.7-billion increase from Budget 2023. The increase is due to increases across

different revenue streams. In addition, the price of West Texas Intermediate (WTI) oil is forecast to average US$79 per barrel over the course of the fiscal year, in line with the Budget 2023 forecast.

- Personal and corporate income tax revenue is forecast at $21.8 billion, $1.8 billion higher than at budget.

- Bitumen royalties are forecast at $14.4 billion, an increase of $1.8 billion from budget.

- Overall resource revenue is forecast at $19.7 billion, $1.3 billion higher than the budget forecast.

Beginning in 2024, Alberta's government will continue to offer fuel tax relief when oil prices are high, even as the province transitions back to the original fuel tax relief program, which is based on average quarterly oil prices.

- Albertans will save some or all of the provincial fuel tax on gasoline and diesel when oil prices are $80 per barrel or higher during each quarter's review period.

- Although oil prices have been below $80 in recent weeks, Albertans will continue to save at least four cents per litre on the provincial fuel tax in the first three months of 2024 as the tax is phased back in.

- The government's fuel tax relief efforts, which include the pause to the end of 2023 and additional savings over the first three months of 2024, are forecast to reduce other tax revenue by $524 million in 2023-24.

New Alberta Carbon Capture Incentive Program (ACCIP)

Alberta is a global leader in carbon capture, utilization and storage (CCUS) development and regulation, and the new Alberta Carbon Capture Incentive Program (ACCIP) will provide major industries with up to 12 per cent of new eligible capital project costs. The ACCIP will help businesses in multiple industries, such as oil and gas, power generation, hydrogen, petrochemicals and cement, reduce their emissions by incorporating CCUS technology into their operations.

CCUS is currently the only viable option available for these industries to significantly reduce their emissions. Provincial funding will be available once the federal government has legislated its CCUS investment tax credit and related operating supports, such as contracts for difference. The federal government originally

proposed the investment tax credit in their 2021 budget. The Alberta Carbon Capture Incentive Program will build on the federal investment tax credit.

Together, the provincial and federal governments can cooperate in establishing the clear competitive advantage in CCUS that Alberta and Canadian businesses have demonstrated to the world. The government is currently working on program specifics with more details expected to be available in spring 2024.

Request for Proposal (RFP) to enhance drought modelling and help prepare for 2024

Alberta relies on melting snow and rain for most of its water. A lack of rain and early depletion of mountain snow led to drought in parts of the province this summer and below average precipitation has continued through the fall.

The government is issuing a request for proposal to help conduct modelling throughout the winter, and to work with municipalities, water users, industry and others to explore ways to maximize the province's water supply, if needed.

Request for proposal - Drought Emergency Management Support: Water Sharing Agreements

Alberta.ca/drought

View this announcement online

Alberta Sovereignty within a United Canada Act resolution

Premier Danielle Smith has introduced an Alberta Sovereignty Within a United Canada Act resolution to protect Alberta from the federal government's proposed net-zero electricity grid regulations to ensure Albertans have access to reliable and affordable power when and where they need it. The resolution asks Alberta's cabinet to order all provincial entities not to recognize the constitutional validity of, enforce, nor cooperate in the implementation of the CERs in any manner, to the extent legally permissible. This order would not apply to private companies or individuals. The resolution also asks Alberta's government to work with the Alberta Electric System Operator, Alberta Utilities Commission and others to implement various reforms to Alberta's electrical system to ensure grid affordability and reliability.

In addition, the resolution instructs the government to work with industry, regulators and other groups to study the feasibility of establishing a provincial Crown corporation for the purpose of bringing and maintaining more reliable and affordable electricity onto the grid in the event that private generators find it too risky to do so under the CERs.

This Alberta Crown corporation would be a provincial entity and would not recognize the CERs as constitutionally valid. If needed, the Crown corporation would work with industry and other stakeholders to bring on needed electricity onto the grid, either through building new generation or purchasing existing generation assets (i.e. natural gas power plants) that private industry would otherwise not build or shut down due to the uncertainty and penalties established by the CERs. It could also be used as a means of assisting and partnering with industry to de-risk investments in nuclear power and other emerging green generation if needed. View this announcement online

Advocacy in Action

Underused Housing Tax Legislative & Regulatory Proposals

In Budget 2021, the government announced that it would introduce a national, annual 1-per-cent tax on the value of non-resident, non-Canadian owned residential real estate that is considered to be vacant or underused. The Underused Housing Tax (UHT) took effect on January 1, 2022.

In response to suggestions from Canadians about the implementation of the UHT, the government is now proposing to make several changes to the UHT to help facilitate compliance, while ensuring that the tax continues to apply as intended.

You can submit your feedback by January 3, 2024: Consultation-Legislation@fin.gc.ca

Our Chamber, co-sponsored a policy with the Airdrie Chamber this past fall and will be submitting a letter with these recommendations.

Our policy process at the Chamber starts when members bring an issue to our attention - this can happen through conversations, committees, or through our Business Advocacy Submission form (https://chamber.southeastalbertachamber.ca/business-advocacy-submission). Last year, the Underused Housing Tax (UHT) was raised by a number of our members as an issue. We came to understand that there were unintended consequences to this government policy, so we worked with the Airdrie Chamber of Commerce to submit a policy to the Canadian Chamber of Commerce that recommends the Government of Canada:

- Exclude CCPCs, substantive Canadian partnerships, Canadian trusts with Canadian trustees and beneficiaries, Canadian bare and deemed trusts from the list of required UHT-2900 filers.

- Reduce the $10,000 penalty to be consistent with the penalties applied to late-filed information returns and adopt a more lenient approach for late filing of the UHT forms, including appropriate appeal procedures.

- Revise the UHT form to streamline the process for corporations by allowing them to list all their owned residences in a single section, instead of requiring multiple submissions.

Now, the Government of Canada is seeking feedback on proposed changes to the legislation relating to the elimination of filing requirements for certain owners and a reduction to the minimum penalties for failure to file. Our Chamber will be submitting a letter in response to this request by government based on our policy, and we're seeking additional feedback from our membership. To have your input included in our letter, please email your comments to industry@medicinehatchamber.com. To submit your feedback directly to the government for submission, you can email consultation-legislation@fin.gc.ca.

Letter to the Senate on Bill C-234

The Canadian Chamber is calling on the Senate to swiftly adopt Bill C-234 (An Act to Amend the Greenhouse Gas Pollution Pricing Act) - without amendments - and give Canadian farmers and consumers the relief they urgently need. This will strengthen our national food security and especially help Canadian struggling to cope with high inflation. Bill C-234, as it was passed by the House of Commons, adequately addressed the concerns of Canadian farmers by exempting them from the carbon tax for on-farm use of propane and natural gas. The Parliamentary Budget Office estimates that these measures would collectively save Canadian farmers nearly $1 billion by 2030. These savings will be especially critical as rising input costs and interest rates squeeze farm profitability across the country. Ensuring our farmers are able to continue to invest, grow, and feed Canadians and the world should be paramount amidst growing food security concerns. Read the letter.

Let's plan: Provincial Budget 2024

Albertans are invited to share their views as the government develops Budget 2024.

Feedback from Albertans is an important part of the budget process and will help set the province's financial priorities. Budget 2024 will further the government's commitment to balance the budget, address growth pressures, keep life affordable and stand up for Albertans.

Albertans are encouraged to fill out the Budget 2024 online survey and join telephone town halls with President of Treasury Board and Minister of Finance Nate Horner. Businesses, municipalities, industry associations, community organizations and other groups can send budget submissions on behalf of their organizations through an online portal. The survey and online submission portal are live until Jan. 19, 2024. Telephone town halls will be held on Dec. 11 and Dec. 12. To participate, Albertans can register online: Budget consultation web page

Next Level Events

Perfecting Your Pitch with Craig Elias

Designed for aspiring entrepreneurs and early-stage business owners, this series shares the secrets to getting customers, investors, and mentors. The series will also cover some of the best ways to access Alberta's business incubators and accelerators.

Each week's session will feature fresh content and the opportunity to practice your pitch and get feedback from the facilitator and the other participants. Register here: https://lu.ma/perfecting-your-pitch-january?mc_cid=3374663e46

Over 50% booths sold, book today! 2024 Home + Leisure Tradeshow

We all know how time flies, and though the Trade Show is still a few months away, its ONLY a few months away!! With over 50% booths sold, there are a few corner booths still available but going fast, along with some bulk space for large exhibitors and food truck space available. With thousands of consumers visiting the shows over the course of three days these trade shows give an incredible opportunity to gain exposure for your business, demonstrate and sell products, and showcase your services. Register now and save your space!

State of the City Address

The Annual State of the City Address is where you can learn about the City's progress over the past year and get informed about what's in store for the community in 2024. Join us as we reflect on the accomplishments of our community during 2023, and be the first to hear what the City of Medicine Hat has in store for the coming year including exciting new projects, opportunities for development, and vision for the future.

This event will be held at the Medicine Hat Lodge January 23rd, 2024. Doors will open at 11:00am followed by lunch and The State of the City Address from 12:00-1:30 pm. Tickets for this event are $70+ gst which includes your meal and registration. If you are a Chamber Member please remember to log in during registration to take advantage of your discount! Register here

Enriching Your Business

There's a reason Chambers Plan is Canada's #1 plan.

Contact JoAnne Letkeman,

Exclusive Chamber Group Advisor,

403-504-2166 ext 1.

Fueling the Business Community

• NEW MEMBERS •

We would like to welcome Volare Drone Innovations ltd. and Fraser's Plumbing and Gasfitting to the Chamber Family!

We continually look forward to helping our members during their business journey and wish each the best in all future endeavors. We are extremely happy to have such amazing members, and are very glad that we can serve a part in that journey! Keep your eye out for more new member posts moving forward!

We had our AGM, Member Appreciation and President's Reception!

Last Thursday we had our Annual General Meeting (AGM) at McNally's Tap House. Thank you to everyone who came out to network, catch up, reflect and support the Board, Chamber and our members; we had an amazing turn out and an amazing time!

Congratulations to our members who are entering their 10 years, 20 years, and 100+ years of being Chamber members. We appreciate your support and engagement with the Chamber and are excited to continue serving you and our other member businesses! Check out our member directory here!

For those that want to dive into the data, you can find the report here: https://www.medicinehatchamber.com/publications/ with a specific link to the pages reviewed here: https://www.medicinehatchamber.com/2023annualreport/.

If you have any questions about the Chamber of Commerce, this year's or next year's AGM, our other events, or our report and reflection on this past year please feel free to reach out to us! We can't wait to dive into this next year with you.

Fill Up On Funding

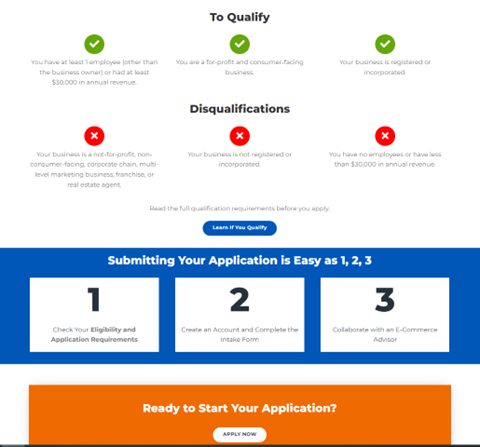

Did you know you can get support through the Canada Digital Adoption Program in multiple ways?

The Business Link and the Canadian Council of Aboriginal Business facilitate part of the Digital Adoption Program to 'Grow Your Business' in the Province of Alberta. You can qualify for a $2,400 grant and the employment of recent graduates of a Marketing program. Find out more here: https://businesslink.ca/canada-digital-adoption-program/eligibility/

You can also 'Boost Your Business'. There are over 600+ of these agencies in Alberta that can assist you in your digital plans:

https://clutch.co/ca/agencies/digital-marketing/alberta

https://digitalmainstreet.ca/vendor-directory/

Plus you can get help through Community Futures Entre-Corp and their Digital Services squad.

Increasing support for non-profits

Alberta's non-profit and voluntary sector contributes to the well-being of communities and improves the lives of Albertans. To further support non-profits, organizations can launch campaigns on the Crowdfunding Alberta platform to boost their fundraising efforts during the giving season and receive up to $5,000 annually in government match-funding. Read more.

Canada Summer Jobs 2024: Application period open until January 10

Employers from not-for-profit organizations, the public sector, and private sector organizations with 50 or fewer full-time employees in Canada can apply for funding to hire young Canadians aged 15 - 30 next summer. The application deadline is January 10, 2024. Learn more

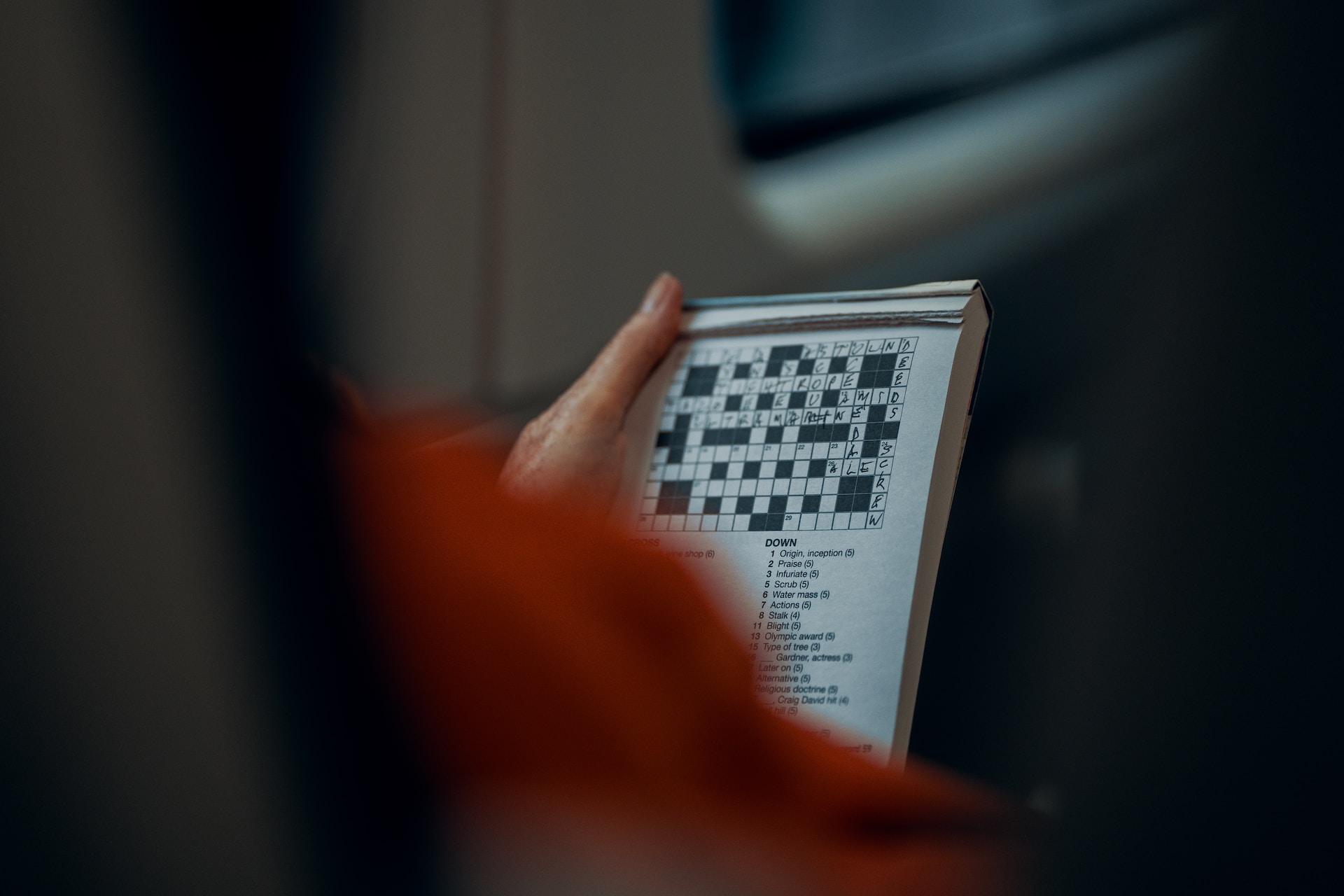

Crossword Puzzle

Crossword Puzzle Answers

Did you figure it out? Here are the answers for the November 27th crossword puzzle.

Remember that if you subscribe to our weekly email, you get access to the crossword puzzle! Anyone who sends us their answers will get their name put into our quarterly draw. The prize? Receive 5 promotional credits with us (for members) or credit towards a membership (for non-members)! Oh and bragging rights that you're a crossword master!

Other News

Government of Alberta- Culture and Status of Women Grants

Alberta has now reduced methane emissions from the oil and gas sector by 45 per cent since 2014

Increasing access to family justice services

Protecting drivers from photo radar fishing holes

Updates to provincial justice legislation

New AHS board to refocus on acute care delivery

How to finance your company's growth projects

Other Resources

Alberta Economy - Indicators at a Glance

Labour Market Notes - Labour market pulls back

31 Holiday Marketing Ideas To Earn More in 2023

What is operational efficiency?

Alberta Regional Dashboard - information about living, working, and doing business in Alberta's diverse regions.

Business Resources for Canadian Service Veterans

Bullying in the workplace: What it looks like and the role you play in stopping it

Other Events

December 5 | Employment Standards in AB - Vacation pay and general holiday pay | Register

December 5 | Optimizing for Search Engines - Understanding SEO Basics | Register

December 6 | Elevate your Career with AI | Register

December 6 | Pathways to Permanent Residence I Register

December 7 | EDC Global Economic Outlook: Preparing for business in 2024 | Register

December 13 | Retail Conditions Report: Holiday Edition | Register

December 13 | Mental Health Workshop- Trauma in Entrepreneurship | Register

Useful Links

Find more updates on our social media